Research Note: Private Equity’s Focus on the Insurance P&C Claims Landscape

Published October 2023

Private Equity’s Focus on the Insurance P&C Claims Landscape

Summary of Main Takeaways

- In an era of macroeconomic uncertainty, investors are increasingly seeking out stable, counter-cyclical companies that are uncorrelated to the broader economy or consumer spending

- While there are entrenched incumbents, private equity investors are looking to create nimble, tech-enabled platforms from smaller players (often through the merger of several small to mid-sized companies) to compete with higher quality service

- Private equity investors are shifting focus from insurance distribution to claims servicing as the “next frontier” of insurance services due to the following reasons, which make the industry highly attractive

- Fragmentation and consolidation opportunities

- Legacy technologies and incumbents create opportunities for technology enablement

- Large market gap between large, scaled incumbents and smaller regional competitors

- Lack of succession plans by owners

Executive Summary

During global macroeconomic unpredictability, the insurance services sector is emerging as an area of stability for private equity investors. While in recent years there has been a pronounced influx of capital into the distribution space, the dynamics have shifted, paving the way for the claims space to take center stage, especially founder-owned TPAs and independent adjusting firms. This increased interest in claims arises from its fragmentation, technological enhancement opportunities, and the potential to bridge the market gap between large-scale players and smaller entities. Executives and investors in the space

At Evolve, we’ve seen a growing appetite from private equity firms on entering the arena. Their approach is characterized by a desire to consolidate multiple entities at the outset, aiming to establish a diversified platform that serves as a viable alternative to the industry’s leading players (representative transaction: New Mountain Capital simultaneously acquired Donan and CCG IQ in December 2021, forming Alpine Intel). With the distribution space perceived as saturated, the claims services sector is positioned to be the next significant frontier in private equity’s play in the insurance services vertical.

Emerging Interest in the Insurance Services Sector: A Focus on Claims

In the ever-shifting landscape of PE-land, there remains a constant in today’s volatile market – the search for stability. As global macroeconomic environments are marked by unpredictability, savvy groups are making rotations towards areas that demonstrate resilience against such volatilities. One such sector is the insurance services industry.

Macro Backdrop:

The prevailing macroeconomic environment has left many investors searching for sectors that can weather economic fluctuations. It is in this context that insurance services companies have emerged as attractive investment avenues, garnering more interest now than they did just two to three years ago.

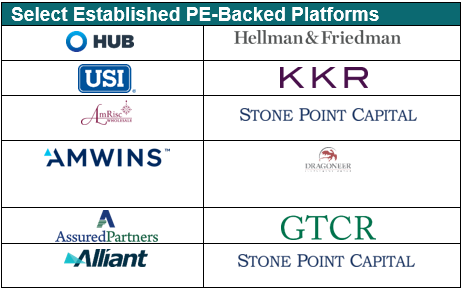

In recent times, we’ve seen an influx of private equity capital intothe distribution space, notably within areas like wholesale brokers and MGAs. Historically, these areas have been characterized by fragmentation and a noticeable lag in the adoption of technology-enhancing processes. The consequent influx of substantial capital from mega-funds such as Hellman & Friedman (HUB), KKR (USI), and Dragoneer (AmWins) has changed the competitive landscape, making it challenging for newer entrants to match the established players in terms of price and scale.

Why the Focus to Claims?

Given the competitive dynamics in the distribution space, entrants are exploring alternative avenues in the claims ecosystem.

The Appeal of the Claims Space:

Several factors make the claims space particularly attractive to private equity:

- Fragmentation and Consolidation Opportunities: Similar to distribution, the claims sector is marked by fragmentation, offering ample opportunities for synergies through potential consolidations.

- Technological Advancement Opportunities: The prevalent technology within claims is somewhat dated compared to other sectors, presenting opportunities for process optimization and overall business enhancement.

- The Market Gap: A notable gap exists between dominant players such as Sedgwick and smaller, family-owned entities. This gap presents an opportunity for the development of a mid-tier player that can offer quality services akin to industry leaders while maintaining close-knit, family-oriented relationships. And local market knowledge.

- Lack of Succession Plans: Many business owners within this sector lack succession plans, making it an appealing proposition for them to transition their businesses, ensuring liquidity and providing a stable future for their employees.

Current Investment Trends in Claims:

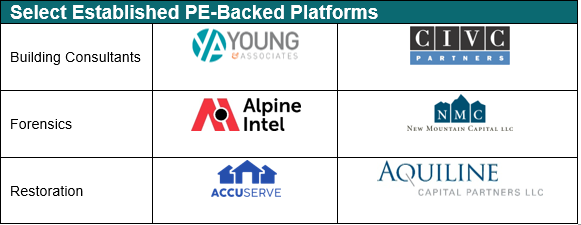

Private equity firms are recognizing that smaller entities in the claims space are often seeking alternatives to joining industry giants. Firms like Trive Capital and Longshore Capital are making strategic plays in this area, indicating a trend towards consolidation and the building of diversified platforms (representative transaction: Longshore Capital acquired Southwest Adjusters in 2022). Other investment trends within this sector include ventures into building consultancy, forensics, and restoration, with firms such as CIVC and New Mountain Capital leading the charge (representative transaction: YOUNG & Associates acquired IN-Line Consulting in September 2023).

Evolve’s Concluding Remarks

Our firm, Evolve, has noted a marked uptick in interest from private equity firms exploring opportunities within the insurance and claims service ecosystem. With the distribution space now becoming increasingly saturated, the focus is undoubtedly shifting towards insurance claims services – the “next frontier.”

Evolve foresees a future where these firms will be interested on amalgamating multiple entities from the get-go, aiming to provide scale, mitigate risks, and offer a formidable alternative to the current industry stalwarts. As this landscape continues to evolve, our commitment remains to provide our clients with insightful, timely, and strategic advice in navigating these promising investment themes.