Research Note: Evolve’s 2023 Macroeconomic Outlook

Published January 2023

2023 Macroeconomic Outlook: Market Conditions will Precipitate a Trend towards Value Stocks; Privately Held, Founder-Owned Businesses and Businesses which Provide Mission-Critical Services

Summary of Main Takeaways

- Markets in 2022 experienced their worst performance since the financial crisis of 2008.

- Initial public offerings experienced their worst year in decades in 2022, with 214 companies raising a combined $21.8 billion.

- A bright spot in the M&A space has been the M&A market in the Americas, which accounted for 48 percent of global deal value.

- In addition, private equity dealmaking has accounted for a significant share of overall M&A deal value and has been a primary factor in the increase in premiums in 2022. Private equity has over $2 trillion on portfolio investments, and the result was a rise in 2022 deal premiums to 41 percent in 2022 from 35 percent in 2021.

- 2023 will be characterized by continued monetary tightening, albeit at a reduced pace.

- Geopolitical risks will continue to concern companies and investors in 2023.

- Global demand and supply will be affected by a multitude of factors, including positive developments such as the reopening of the Chinese economy from its pandemic lockdown; geopolitical risks with the war in Ukraine; tensions between China and Taiwan; and North Korean provocations.

- Traditional insurance companies have been experiencing a hard market since 2019. Personal & Commercial lines and Life insurance prices have risen for six consecutive quarters producing steady increases in premium revenue.

- In our view, claims inflation appears to be a short-term negative but an intermediate and longer-term tailwind for future premium growth and higher profitability.

- A fertile field for acquisition growth and opportunities for ample profitability & capital growth exists for traditional insurance companies in 2023

- With equity and bond market volatility predicted to continue into 2023, trading and capital market firms should continue to reap positive benefits.

- Coming out of 2022, commercial banks possess sufficient high-quality liquid assets, capital, and credit reserves to be well-positioned to withstand any economic slowdown that may occur in 2023.

- Investors will protect their assets by investing in defensive and value stocks.

- Until economic turbulence subsides, investors will look to safe stocks that are stable and cash flow positive. This trend is already noticeable as value stocks outperform growth stocks by margins last seen during the Financial Crisis.

- The state of the market and the broader economy, as we begin 2023, are such that investors are likely to look to value and defensive stocks and privately held, founder-owned businesses to earn a return.

Big Picture

The general economic outlook for 2023 is awash in uncertainty as expectations regarding continued monetary tightening and fiscal deadlock in the United States. Investor confidence in a potential uptick in demand was buoyed by the Chinese Government’s decision to ease its COVID-related restrictions.

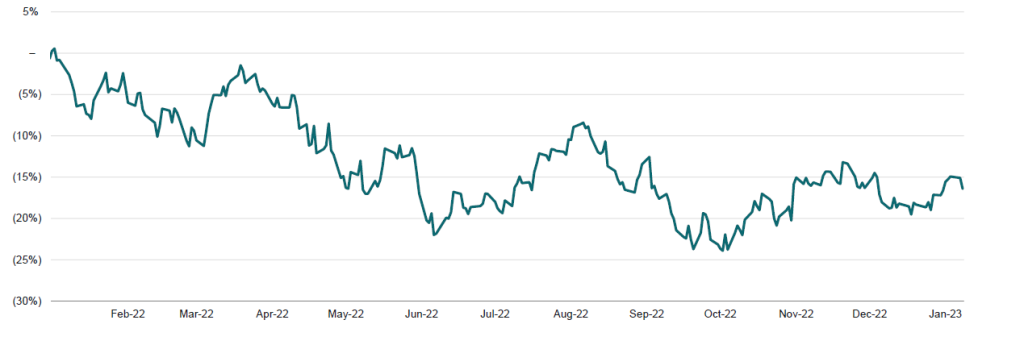

Markets in 2022 experienced their worst performance since the financial crisis of 2008. Global stocks, including those in the United States, experienced a 20 percent decline, including a 15.9 percent decline by the S&P 500 and a 13.8 percent decline by the S&P 500 Financials Index over the trailing 12 months. However, there have been reasons for optimism about the market moving forward.

U.S. third-quarter GDP was revised upwards to 3.2 percent from 2.9 percent. In its final meeting of 2022, the Federal Reserve Board raised rates by 50 basis points, the smallest increase of the year. The Fed’s decision was predicated on news that the November Consumer Price Index showed annualized inflation at a post-COVID low of 7.1 percent from a high of 9.1 percent in June. As of January 3, inflation stood at 6.78 percent.

The state of the market and broader economy are such that investors are likely to look to value and defensive stocks and privately held, founder-owned businesses to earn a return. Until economic turbulence subsides, investors will look to safe stocks that are stable and cash flow positive. This trend is already noticeable as value stocks outperform growth stocks by margins last seen during the Financial Crisis.

As for Evolve’s clients, broader financial services will benefit from the push to invest in value stocks. Traditional insurance and banks, long seen as value stocks, are well-positioned to navigate any continued economic turbulence due to strong capital positions and above-average liquidity. Second, banks profit from rising interest rates due to their ability to raise rates in their lending businesses. In addition, loan loss reserves are expected to be modest and manageable. Finally, banks may be beneficiaries of a turbulent market as such conditions are likely to protect against competition from upstart competitors in fintech.

On the regulatory front, financial services firms must take note of a bevy of issues:

- The U.S. Supreme Court will review the constitutionality of the funding structure of the Consumer Financial Protection Bureau (CFPB), one of the most active regulators of the broader financial services sector during the current Administration. The CFPB has promised to increase its oversight of banks that do not comply with the regulatory regime.

- The financial services sector will need to invest more in social priorities such as environmental, social, and governance (ESG) assets, beyond-banking offerings, and advanced analytics. ESG investing is being aggressively promoted by the U.S. Federal Government and international organizations.

Macroeconomic Trends Impact on Insurance, Capital Markets, and Lending

Insurance

- Traditional insurance companies have been experiencing a hard market since 2019. Personal & Commercial lines and Life insurance prices have risen for six consecutive quarters producing steady increases in premium revenue.

- Climate-related high-catastrophe losses have continued to impact the industry and claims experience.

- The insurance vertical is also not immune from the pressures of inflation.

- Inflation and catastrophe losses from wildfires and storms are pressuring margins causing companies to seek pricing increase offsets due to rising claim costs due to materially higher repair & replacement costs.

- Claims inflation will eventually directly impact margins, pressuring further pricing increases until premium rate increases take effect.

- In our view, claims inflation appears to be a short-term negative but an intermediate and longer-term tailwind for future premium growth and higher profitability.

- Technological advances, a changing distribution landscape, and an evolving underwriting skills gap are other issues that Insurers are facing as we begin 2023.

- Developments in software, hardware, underwriting & claims insurtech capabilities have become increasingly important and cost-effective.

- Consolidation among brokerages and agencies has made it increasingly important for insurers of all kinds to maintain strong broker relationships.

- In combination with the evolving nature of work, competition from private equity-backed firms, MGAs, and new insurtechs have resulted in a rush for experienced underwriting personnel. A talent & skills gap and a scarcity of experienced underwriters have resulted.

- Traditional insurers will likely respond by pursuing every prudent means to acquire talent and technology to fortify their platforms.

- In light of the aforementioned, we believe that 2023 provides a fertile field for acquisition growth and opportunities for ample profitability & capital growth.

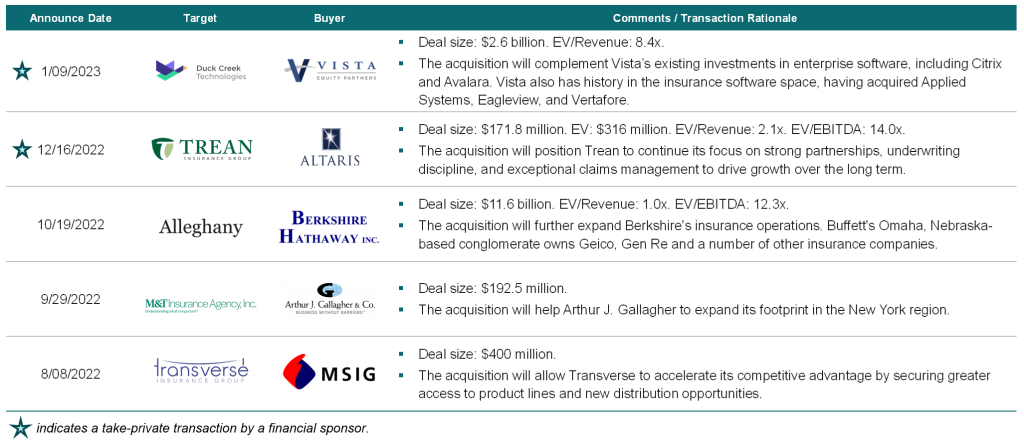

Recent Insurance Precedent Transaction Activity

Capital Markets

Capital Markets

Trading and Capital Markets Firms

- The post-pandemic macroeconomic environment, characterized by weak equity and bond markets in 2022, government regulation & oversight, and increasing inflation, has forced asset managers to rethink their risk pricing and asset retention strategies.

- In 2023, size and AUM will matter for asset management companies of all stripes.

- Slowing globalization of trade, rising interest rates, and reduced fiscal stimulus have changed the calculus of asset managers.

- Long-Short hedge funds and trading firms, on the other hand, have experienced strong trading profits over the past two years due to increased market volatility.

- With volatility predicted to continue into 2023, trading firms should continue to reap the benefits.

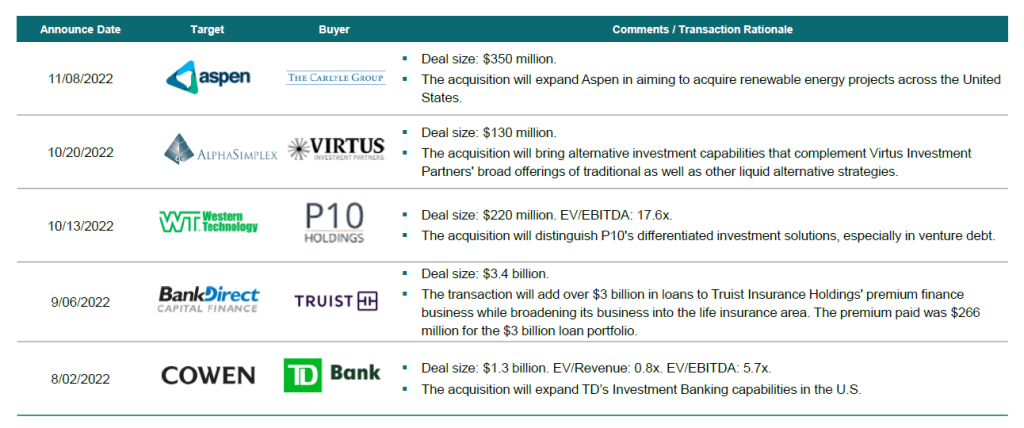

Recent Capital Markets Precedent Transaction Activity

Lending

Lending

Banks

- Commercial and community banks will continue to benefit from rising interest rates in the short term and uncertainty in the long term.

- Banks with customer bases weighted towards clients susceptible to macroeconomic slowdowns (capital-intensive businesses) will face uncertain long-term profitability.

- Corporate banking and mortgage lending earned returns on equity of approximately seven percent in 2022, while banks serving less capital-heavy businesses, including everyday banking, payments, and wealth management reported returns greater than 20 percent.

- Technology firms are increasingly looking towards financial services, payments, and credit services as their core businesses continue to be negatively impacted by macroeconomic conditions.

- Fortunately, banks continue to maintain sufficient high-quality liquid assets, capital, and credit reserves and are well-positioned to withstand an economic slowdown in 2023. Even more fortunate, they are structured to rebound quickly.

Nonbank Financial Institutions

- Nonbank financial institutions continue to lever their balance sheets, reaching an accumulated record high of $2 trillion in 2022.

- The most active actors in the credit markets are private equity firms, business development companies, and credit funds.

- A lack of public disclosure requirements for nonbank financial institutions’ alternative funding vehicles presents a volatility risk to the broader financial services sector in addition to nonbank financial institutions themselves.

Sustainable Finance

- Sustainable finance continued to grow in 2022 and represents a sizable share of business for the financial services sector.

- Opportunities exist within corporate and investment banking as mega-corporations, and carbon-intensive businesses access the M&A market to restructure their business models to meet new carbon emission mandates.

- Within asset management, institutional investors continue to focus on environmental, social, and governance investments, mostly in the form of climate financing as social and regulatory pressure rachet to address the climate change crisis.

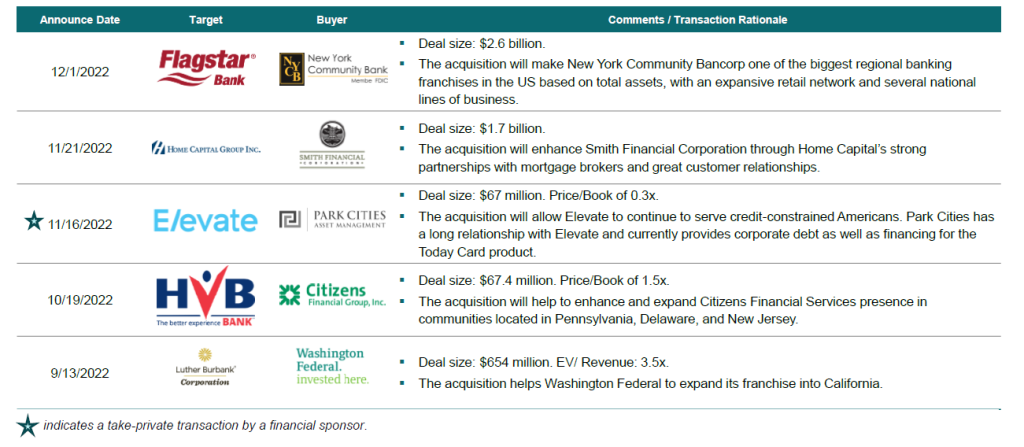

Recent Lending Precedent Transaction Activity

Overview of the Macro Environment

Capital Markets

Initial public offerings experienced their worst year in decades in 2022, with 214 companies raising a combined $21.8 billion. Market volatility, poor returns, inflation, geopolitical risks, and the ongoing effects of the pandemic are the most prominent factors contributing to the IPO market’s poor performance in 2022.

Follow-on offerings by companies faced similar yet less intense headwinds raising $48 billion in 2022. The $48 billion in follow-on offerings represents the lowest amount of capital raised since 1995.

Broker-dealers have experienced strong trading profits over the past two years due in large part to heightened market volatility. However, on the transaction front, global M&A activity slowed in 2022 from its peak in 2021.

A bright spot in the M&A space has been the M&A market in the Americas, which accounted for 48 percent of global deal value. In addition, private equity dealmaking has accounted for a significant share of overall M&A deal value and has been a primary factor in the increase in premiums in 2022. PE has spent greater than $2 trillion on portfolio investments, and the result has been a rise in 2022 deal premiums to 41 percent in 2022 from 35 percent in 2021. Strategic companies’ boards are focused on diversifying their supply chains and investing in economically and politically stable markets such as the United States.

Geopolitical Risks

- Geopolitical risks will continue to be a concern for companies and investors in 2023.

- The Russian-Ukrainian conflict shows no signs of ending.

- Tensions between China and Taiwan have the potential to rachet up at any time.

- The uncertainty surrounding China and Taiwan is of significant concern due to China’s status as the world’s second-largest economy and Taiwan’s status as the largest manufacturer of semiconductors in the world.

- North Korea continues to make hostile statements and provocations.

GDP

- The U.S. Federal Reserve Board released its consensus 2023 GDP growth forecast of 0.5 percent, indicating their belief in continued economic headwinds. It’s important to note that these projections were released before China’s surprise relaxation of its restrictive COVID policies.

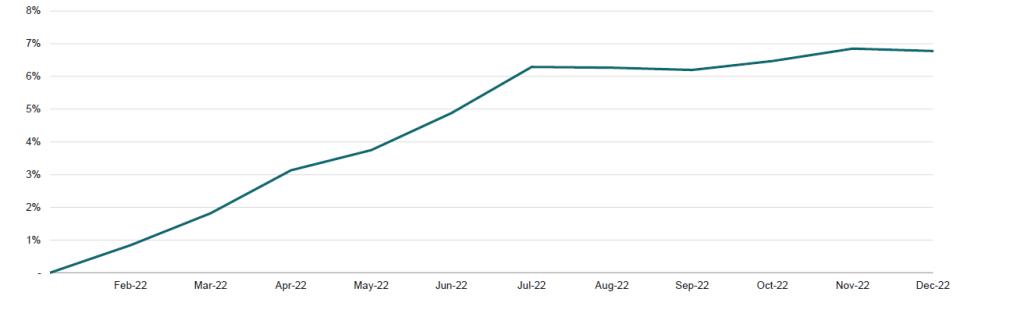

Inflation

- December’s Consumer Price Index report showed improving inflation, with inflation dropping from a post-pandemic high of 9.1 percent in June 2022 to 6.5 percent.

- The Federal Reserve expects inflation in 2023 will continue to correct course but remain above its targeted two percent threshold with an annual increase in prices of 5.1 percent.

- Notable declines in prices were seen in the energy, used vehicles, durable goods, wages, and apartment rentals market verticals.

- The housing market, and apartment rentals, in particular, are cooling off as concerns about a potential recession and reduced occupancy are pressuring already inflated rental prices.

- While most of the inflation news is positive, one area of concern is inflation from wage growth. Wage growth in the service sector continues on an upward trajectory due to a lack of demand for jobs from workers.

Interest Rates

- In its last policy meeting of the calendar year 2022, the U.S. Federal Reserve reduced the pace of its rate increases to 50 basis points from the 75-point increases in the previous three meetings.

- By slowing the rate at which it is raising interest rates, the U.S. Fed is demonstrating confidence that inflation is beginning the process of normalization.

- The Federal Reserve is unlikely to make a dovish turn on interest rates. Fed. Chair Jerome Powell had expressed on several occasions that he remains mindful of the mistakes of the 1970s and 1980s when central banks reversed course on rate hikes too soon, leading to prolonged inflation.

Concluding Remarks

While the outlook for the general economy remains unclear, financial services are primed to benefit from the economic headwinds. Further tightening of monetary policy and anticipated fiscal gridlock in the United States due to the Republican takeover of the U.S. House of Representatives will push investors to increase their stakes in value and defensive stocks with reliably positive cash flows. Financial services companies with a history of positive cash flows on a macro level stand to benefit from this trend.

Financial services, including insurance companies and banks, are positioned to weather any turbulence, given strong capital reserves and liquidity.

Additional growth in financial services will come from increased cooperation and potential joint ventures with technology companies seeking to limit losses with investments in more stable industries.

The state of the market and broader economy are such that investors are likely to look to value and defensive stocks and privately held, founder-owned businesses to earn a return.

Consumer Price Index

S&P 500 Index

S&P 500 Financials Index

REFERENCES

*Note: Some of these articles are behind a paywall.

“A Changing Rate Environment Challenges Bank Interest Rate Risk Management,” https://www.fdic.gov/regulations/examinations/supervisory/insights/sisum05/sisummer05-article1.pdf.

“A Shift in Market Leadership is Reassuring When Stocks Get Frothy,” https://www.wsj.com/articles/a-shift-in-market-leadership-is-reassuring-when-stocks-get-frothy-11620644865.

“Banks Used to Provide Relief From Inflation. Now They Profit Big,” https://www.bloomberg.com/news/articles/2022-07-31/banks-used-to-provide-relief-from-inflation-now-they-profit-big.

“Big Investors Warm to Bonds After Historic 2022 Sell-Off Boosts Yields,” https://www.ft.com/content/974e805d-0163-40f7-8068-17473bed3af2.

“Big Tech Pushes Further into Finance,” https://www.economist.com/business/2022/12/15/big-tech-pushes-further-into-finance.

“Brutal Year Smashes Share Sales in IPOs and Follow-On Equity Raises,” https://www.bloomberg.com/news/articles/2022-12-30/follow-on-raises-pick-up-in-q4-while-ipo-crash-continues-to-end?srnd=markets-vp.

“Charting the Global Economy: China’s Slump Deepens Into Year End,” https://www.bloomberg.com/news/articles/2022-12-31/charting-the-global-economy-china-s-slump-deepens-into-year-end.

“Deglobalization Will Drive Dealmaking in 2023,” https://www.bloomberg.com/opinion/articles/2022-12-29/preview-2023-bloomberg-s-chris-hughes-says-deglobalization-will-drive-deals?srnd=deals/

“Fed Hikes Interest Rates Again, Projects Very Weak Growth for the Economy in 2023,” https://www.usnews.com/news/economy/articles/2022-12-14/fed-hikes-interest-rates-again-projects-very-weak-growth-for-the-economy-in-2023.

“Financial Stability Report – November 2022,” https://www.federalreserve.gov/publications/2022-november-financial-stability-report-purpose-and-framework.htm.

“Global Insurance Report 2023: Reimagining Life Insurance,” https://www.mckinsey.com/industries/financial-services/our-insights/global-insurance-report-2023-reimagining-life-insurance.

“Global M&A Market Slows in 2022 but Shows Signs of Strength,” https://www.mckinsey.com/capabilities/m-and-a/our-insights/global-m-and-a-market-slows-in-2022-first-half-but-shows-signs-of-strength.

“Investors Look Toward Value, Defensive Stocks After Jobs Report,” https://www.wsj.com/livecoverage/stock-market-news-today-08-05-2022-jobs-report/card/investors-look-toward-value-defensive-stocks-after-jobs-report-g5djjU3RYaREjydFNPdi.

“McKinsey’s Global Banking Annual Review,” https://www.mckinsey.com/industries/financial-services/our-insights/global-banking-annual-review.

“McKinsey Technology Trends Outlook 2022,” https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/the-top-trends-in-tech.

“OCC Receives No Objection Notice from SEC on Cloud Infrastructure Proposal,” https://www.theocc.com/newsroom/views/2022/11-07-occ-receives-no-objection-notice-from-sec-on-cloud-infrastructure-proposal.

“On the Independence of Assets and Liabilities: Evidence from U.S. Commercial Banks, 1990-2005,” https://www.fdic.gov/analysis/cfr/working-papers/2008/2008-05.pdf.

“Recession, Rate Hikes, Diversity: What’s Ahead for Banks in 2023,” https://www.bloomberg.com/news/articles/2022-12-27/recession-rate-hikes-diversity-what-s-ahead-for-banks-in-2023?srnd=industries-finance.

“Rotation from Growth to Value Stocks and Its Implications,” https://www.bis.org/publ/qtrpdf/r_qt2203x.htm.

“Stagflation Will Rule in 2023, Keeping Stocks in Peril,” https://web-s-ebscohost-com.proxy.library.cornell.edu/ehost/viewarticle/render?data=dGJyMPPp44rp2%2fdV0%2bnjisfk5Ie46bdIrqexTrSk63nn5Kx789fqjevk51ivpbFHsKawS56quE2zsK5NnsbLPvLo34bx1%2bGM5%2bXsgeKzq1G0ra9PtKy3PvHf4lW2qbZJr6bfe6vc336uo7JOsaurUOOotEW02LVOr9mwe7en4E%2b%2b6ON85%2bmkhN%2fk5VXj5KR84LPgeeac8nnls79mpNfsVa%2bsrkyzrK5Rrpzkh%2fDj34y73POE6urjkPIA&vid=1&sid=838110ac-faf0-4635-8e26-6b761c2c91b7@redis.

“The Procyclicality of FDIC Deposit Insurance Premiums,” https://www.fdic.gov/analysis/cfr/working-papers/2022/cfr-wp2022-10.pdf.

“Value Investing is Back. But How Do You Choose the Right ETF?,” https://www.wsj.com/articles/value-investing-back-choose-right-etf-11648845099.

“What a New Normal of Higher Inflation Means for Investors,” https://www.ft.com/content/6ec6f4c3-950b-439e-8361-0e22d92a17d6.

“Zumper National Rent Report,” https://www.zumper.com/blog/rental-price-data/.